Cash Balance plans operate from an actuarial model that projects a specific value at a defined future point in time. The greatest benefits created by this type of plan are tax deductibility followed by tax deferred growth. A Cash Balance plan allows each participant to deduct well more than the 401(k) and profit sharing maximum of $53,000 (or $59,000 for those 50 and older). This creates an additional source of tax deferred money that is invested for retirement. Upon retirement, like a 401(k) balance, this sum can be rolled over to an IRA for the retirement distribution phase.

See the illustrations below to better understand the required contribution structure and the interest crediting rate system that make up a Cash Balance plan:

Example 1 – a 36-year-old participant who enrolls in the Cash Balance plan and intends to fund it as follows:

- From age 36-45: $50,000/year

- From age 46-55: $100,000/year

- From age 56-65: $150,000/year

The following chart reflects the conceptual design and performance of a fictitious Cash Balance account. The vertical axis on the left represents the annual funding shown on the bar charts (“Actuarial Funding Requirement” and “Hypothetical Funding Requirement”). The vertical axis on the right represents the account balance parameters shown on the line graph (“Actuarial Value,” “Hypothetical Value,” “Excess Boundary,” and “Deficit Boundary”). The horizontal axis reflects the age of the participant.

Focusing on the account values first, the Actuarial Value is the most straight forward and is what the actuarial account value system is based on. In this illustration, it assumes that year-after-year, the account grows at a rate of 3.5%, the “interest crediting rate.” It also assumes that the participant deposits (on January 1 each year) the pre-defined amounts noted above, $50,000 for the first 10 years, $100,000 for the next 10 years, etc.

From an actuarial perspective, this participant starts at $0 and ends at $4.74 million at the end of year 30. Since the real investment markets aren’t that predictable, the participant’s actual returns matter, and in this illustration they are represented on the line graph as the “Hypothetical Value.” For illustrative purposes, this Hypothetical Value was based on the Morningstar category called Allocation–30% to 50% Equity over the 30 year period ending 12/31/2015. This represents how a conservative investment allocation may have performed over that period of time. Clearly, the Hypothetical Value performed differently than the Actuarial Value which means the actuary who reviews the plan on an annual basis must give guidance based upon the account value’s divergence from the Actuarial Value. That guidance is based on ranges outside of which the account value does not need to go.

For this reason, there is a theoretical floor and ceiling that the actuary must keep the account value between. On the chart, this floor and ceiling are represented by the lines titled “Excess Boundary” and “Deficit Boundary.” As the Excess Boundary is approached, the actuary will recommend a smaller funding amount in a given year. This smaller funding amount (Hypothetical Funding Requirement) means that the participant will not be able to make the full tax deductible contribution intended. Rather, a smaller amount is made to bring the value more in line with the Actuarial Value. Conversely, if the value drops near the Deficit Boundary, a larger tax deductible contribution may be required to bring the account in line.

It is this variability that requires the multi-year commitment on the part of the participant. While in certain circumstances, plans can be frozen and contribution amounts can be changed, the goal is to maintain a static or defined funding plan with a conservative-to-moderate investment approach.

In considering this commitment, funding the Cash Balance plan becomes the base of the pyramid of retirement savings. Secondary to that funding, the employer-provided safe harbor and profit sharing are added similar to the current plan’s structure. Finally, the 401(k) funding becomes the variable amount that can be funded or not funded depending on the participant’s financial circumstances at year-end. In other words, in a year when a larger Cash Balance contribution is required due to poor market performance, the participant may choose not to fully fund the $18,000 401(k) contribution (or $24,000 if 50 or older) due to financial constraints.

In considering this commitment, funding the Cash Balance plan becomes the base of the pyramid of retirement savings. Secondary to that funding, the employer-provided safe harbor and profit sharing are added similar to the current plan’s structure. Finally, the 401(k) funding becomes the variable amount that can be funded or not funded depending on the participant’s financial circumstances at year-end. In other words, in a year when a larger Cash Balance contribution is required due to poor market performance, the participant may choose not to fully fund the $18,000 401(k) contribution (or $24,000 if 50 or older) due to financial constraints.

Referring back to the chart above, a participant at age 46 is increasing their Cash Balance funding from $50,000 to $100,000 per their chosen funding levels. In the first year, for example, they may choose not to fully fund their 401(k) to ease into that additional financial commitment. This is simply a strategy to give participants a lever to control their total tax deductible savings on an annual basis.

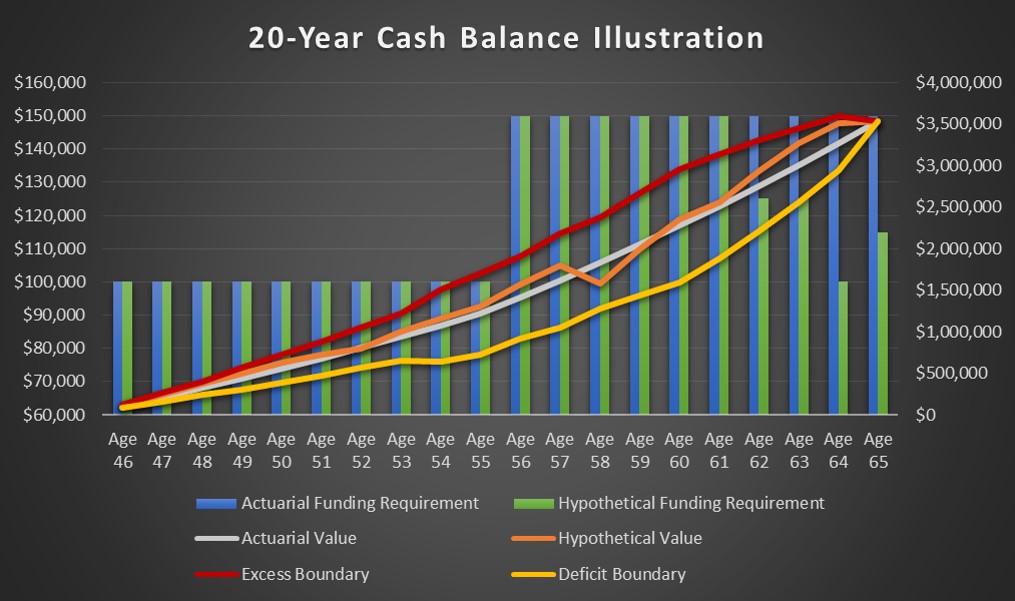

Example 2 – a 46-year-old participant who enrolls in the Cash Balance plan and intends to fund it as follows:

- From age 46-55: $100,000/year

- From age 56-65: $150,000/year

All elements of the chart are the same as Example 1 except for the reduced amount of time the account is in place. This example uses a 20 year period, and the Hypothetical Value is based upon the same Morningstar category as above; however, it is a 20 year period ending 12/31/2015.

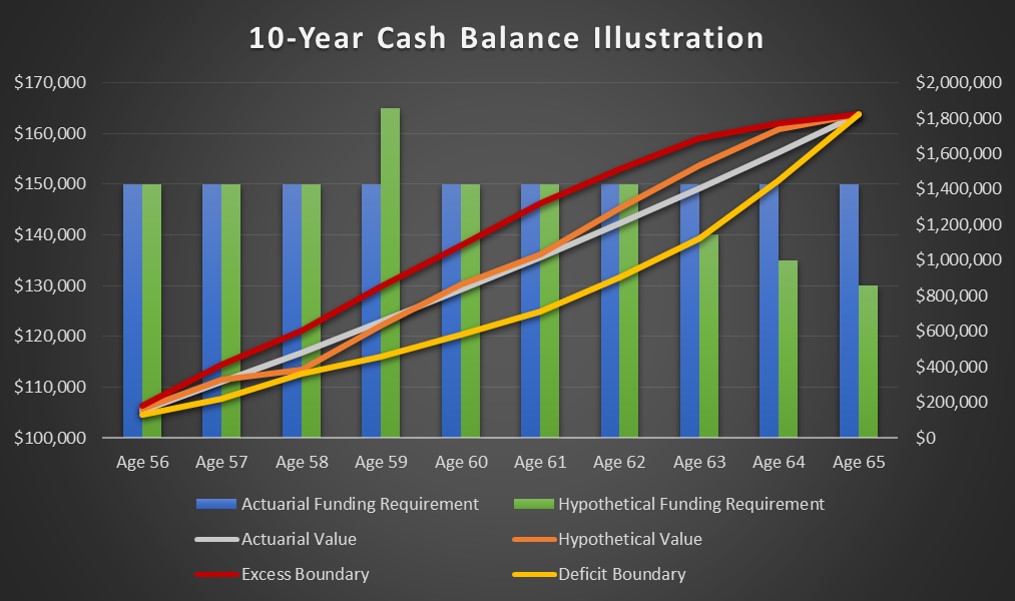

Example 3 – a 56-year-old participant who enrolls in the Cash Balance plan and intends to fund it as follows:

- From age 56-65: $150,000/year

All elements of the chart are the same as the two prior examples except for the reduced amount of time the account is in place. This example uses a 10 year period, and the Hypothetical Value is based upon the same Morningstar category as above; however, it is a 10 year period ending 12/31/2015.

While Cash Balance do have a higher level of complexity than defined contribution plans like 401(k)s, when integrated with a 401(k) Profit Sharing Plan, they can offer participants a tremendous benefit through tax deductible and tax deferred savings.

For questions regarding Cash Balance plans or any investment or retirement strategies, please call Taylor Wealth Solutions’ customer service at (615) 372-1368 or send us a note through our contact form.